Task Force on Climate Related Financial Disclosures (TCFD) reporting: building strong foundations

In line with its Net Zero Strategy, the UK government is in the process of rolling out climate-related disclosure requirements across the UK economy, with the intent to make these fully mandatory by 2025. The disclosures are currently based on the recommendations from the Task Force on Climate-Related Financial Disclosures (TCFD), which focusses on four core areas:

Governance

Strategy

Risk Management

Metrics and Targets

The TCFD disclosure framework is intended to provide the market with decision-useful, forward-looking information on climate-related risks and opportunities, and how firms are identifying, assessing, managing, and mitigating them.

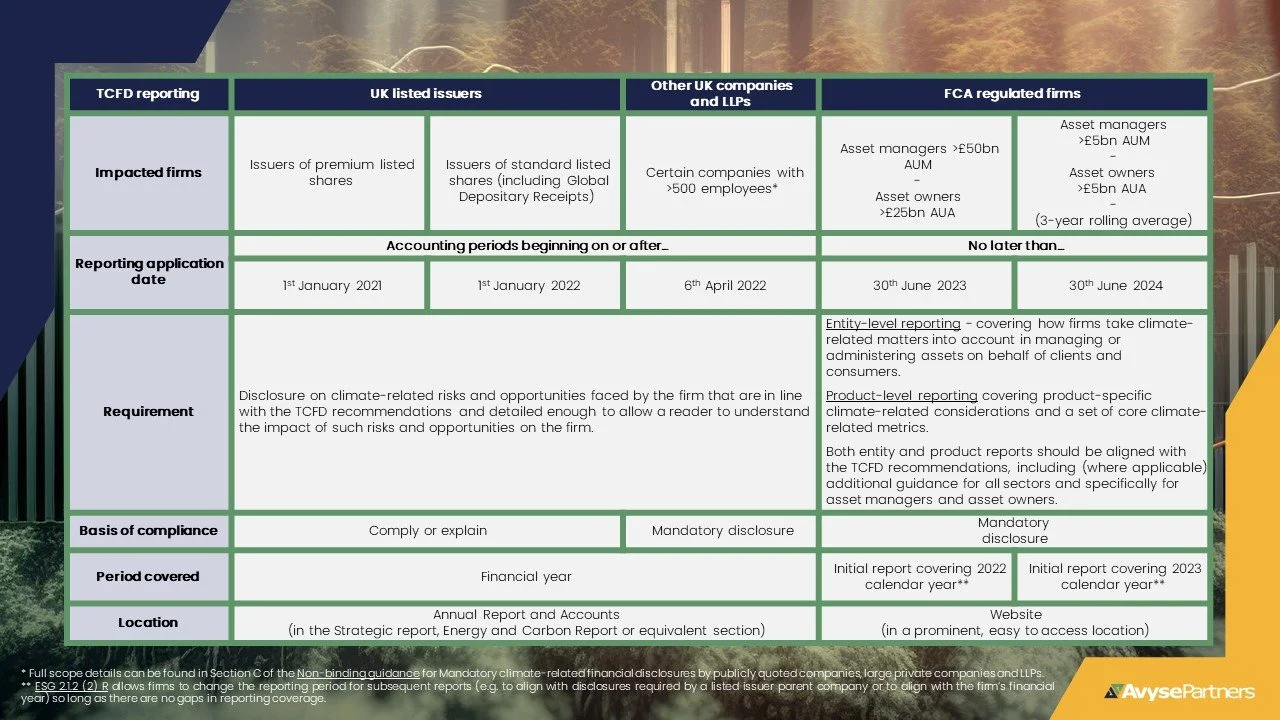

Reporting obligations are already in place for the largest UK companies who were required to report against the TCFD recommendations for financial years beginning on or after 1st January 2021. For smaller companies, Limited Liability Partnerships (LLPs) and Financial Conduct Authority (FCA) regulated firms, many will be issuing their first reports in 2023.

TCFD reporting requirements framework

We have developed a concise reporting framework to help you assess your TCFD reporting requirements:

Practical takeaways

Following the 2022 first round of reporting for premium listed firms the Financial Reporting Council (FRC) and the FCA reviewed a sample of disclosures assessing general compliance with TCFD recommendations and identified areas for improvement. Whether you are reporting for the first time, want to know if your reporting and supporting processes stack up against regulatory expectations, or are simply looking for ways to enhance your existing reporting framework, there were the following takeaways:

Governance arrangements: Do you have adequate governance arrangements to oversee climate-related risks and opportunities, including oversight of reporting requirements and other climate-related regulatory activity? Including reporting and escalation mechanisms to appraise the board on material developments?

Corporate strategy: Have you incorporated climate change into your corporate strategy – particularly where climate-related risks and opportunities are considered material to your firm’s operations?

Compliance frameworks: Are existing and new climate (and sustainability) related requirements embedded in the compliance framework, including ongoing compliance monitoring, thematic review, and other assurance activities?

Assess public narrative: Have you reviewed all public statements made by your firm regarding climate-related matters to ensure these are consistent with the firm’s activities, targets, and climate-related disclosures?

Enterprise risk management (ERM) processes: Have you adapted your ERM framework and associated processes to consider the material physical and transition risks and opportunities and their impact on the firm?

Scenario analysis: Are you carrying out scenario analysis against climate outcomes to identify impacts on the business model and areas of risk? Are you providing clear, transparent rationale on assumptions and methodologies used in the scenario analysis in your disclosures?

Metrics and targets: Have you adopted industry-specific metrics and targets where available? Are you explaining how you have identified key performance indicators (KPIs) and how you are tracking progress towards your targets?

Training and competence: Have you assessed training needs across all levels of the business ensuring staff are equipped to understand, identify, mitigate, and challenge climate-related risks and opportunities?

Stakeholder engagement: Have you engaged with investors and other stakeholders to understand their disclosure expectations?

Disclosure: Have you challenged yourself on the completeness of your TCFD disclosures and how decision-useful the information provided is? Will the information be easily understood by all potential readers?

These takeaways will help firms establish robust climate-related governance and will provide strong foundations for future climate reporting as the UK moves towards the International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards, which are due to be rolled out from 2024.

If you would like to discuss your upcoming TCFD reporting or governance arrangements, please don’t hesitate to get in touch.